Is it Better to Rent or Buy in Today's Market?

Is It Really Better To Rent Than To Own a Home Right Now?

If you're thinking about moving to a new place, you might be wondering whether it's better to rent or buy a home. This is a common question that many people face, especially in today's uncertain economy. There are pros and cons to both options, and the best choice for you depends on your personal and financial situation.

Renting a home can offer you more flexibility, lower upfront costs, and less responsibility. You don't have to worry about maintenance, repairs, property taxes, or homeowners insurance. You can also move more easily if your needs or preferences change. However, renting also means that you have no equity in your home, no tax benefits, and less control over your living environment. You may face rent increases, eviction, or landlord issues. You also miss out on the potential appreciation of your home's value over time.

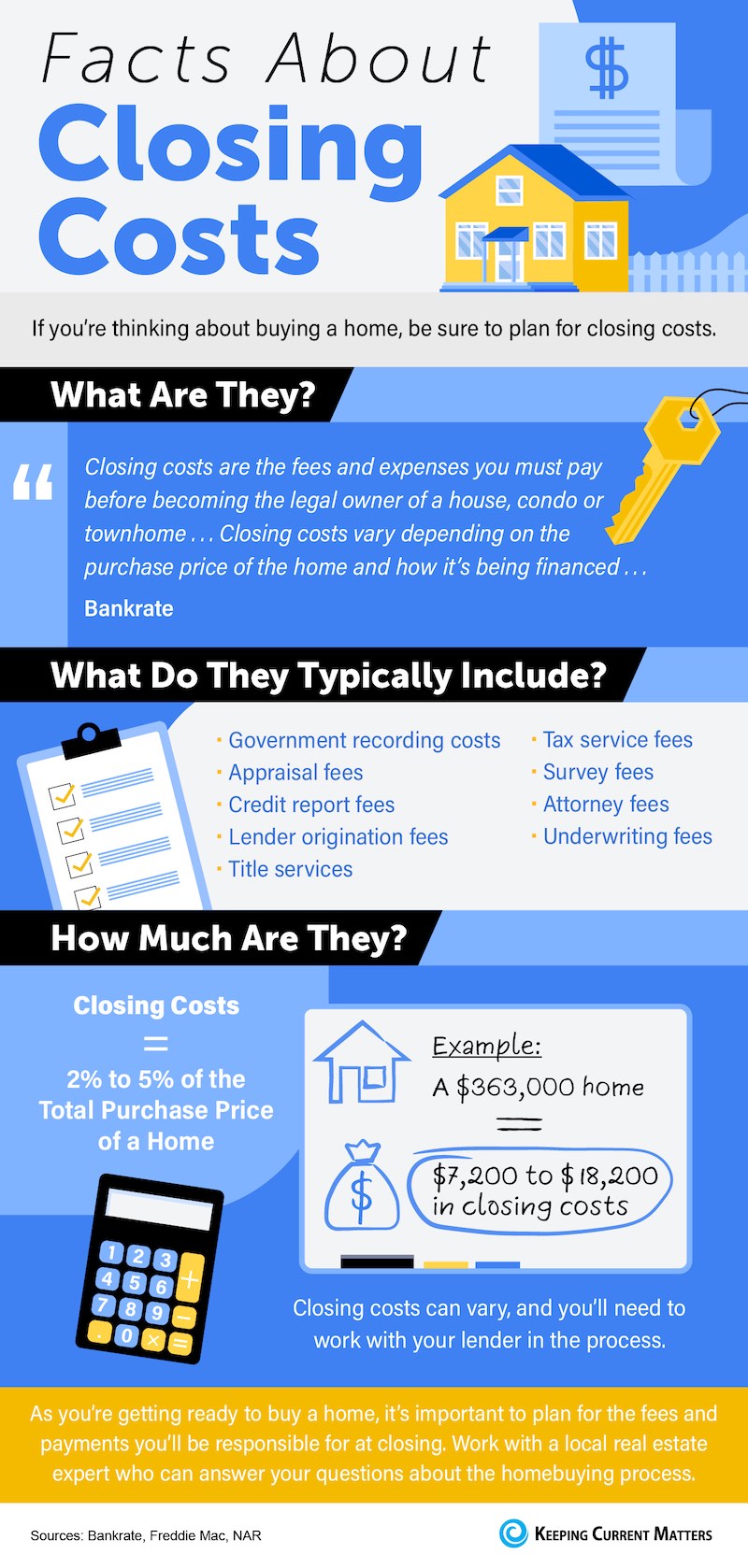

Owning a home can give you more stability, security, and pride. You can customize your home to your liking, enjoy tax deductions, and build equity as you pay off your mortgage. You also benefit from the long-term growth of the real estate market, which can increase your net worth and provide you with a valuable asset. However, owning a home also comes with higher upfront and ongoing costs, more risk, and more hassle. You have to pay for closing costs, down payment, mortgage interest, maintenance, repairs, property taxes, homeowners insurance, and HOA fees. You also have to deal with market fluctuations, natural disasters, or other unforeseen events that can affect your home's value or condition. You also have less mobility and flexibility if you want to relocate or downsize.

So how do you decide which option is better for you right now? Here are some factors to consider:

- Your budget: How much can you afford to spend on housing each month? How much do you have saved for a down payment and closing costs? How stable is your income and credit score? Renting may be more affordable in the short term, but owning may be more cost-effective in the long term.

- Your goals: What are your plans for the future? How long do you intend to stay in your current location? What are your priorities and preferences for your lifestyle and living space? Renting may offer you more freedom and flexibility, but owning may offer you more stability and satisfaction.

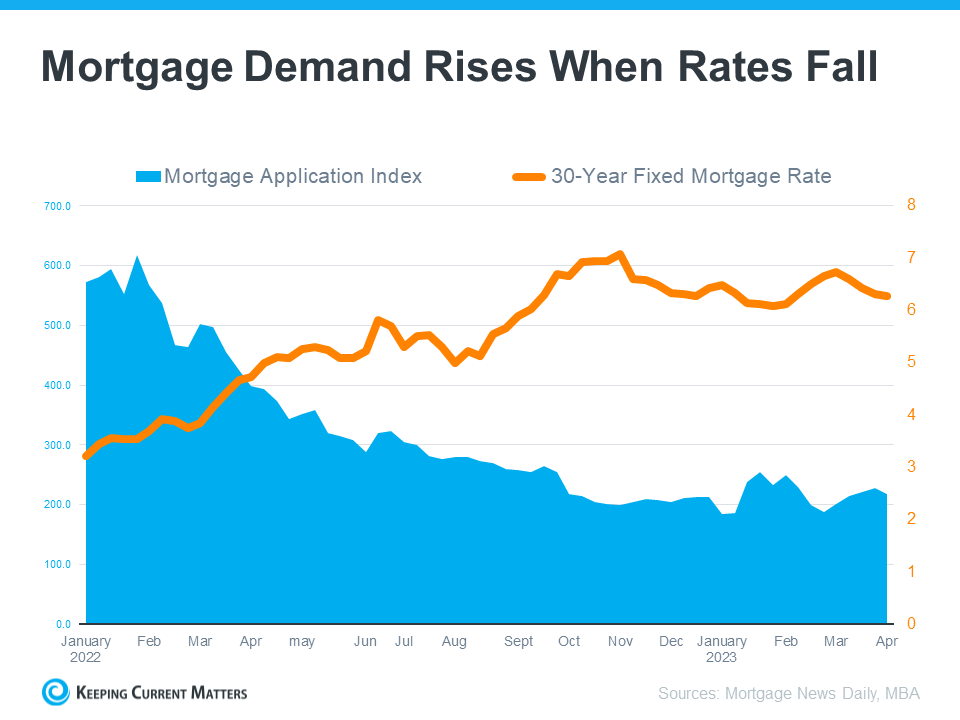

- Your market: What are the current conditions of the housing market in your area? How much are the average rents and home prices? How competitive is the supply and demand? How fast are the rents and home prices changing? Renting may be cheaper than buying in some markets, but buying may be cheaper than renting in others.

To help you compare the costs and benefits of renting vs. owning a home in your area, you can use online tools such as Rent vs Buy Calculators or Rent vs. Own Reports. These tools can help you estimate how much you would pay for rent or mortgage payments, taxes, insurance, maintenance, utilities, and other expenses over time. They can also show you how much equity you would build or how much appreciation you would gain if you owned a home.

Ultimately, the decision to rent or buy a home is a personal one that depends on your unique situation and preferences. There is no one-size-fits-all answer to this question. The best thing you can do is to weigh the pros and cons of each option carefully and realistically. Consider your current needs and goals as well as your future plans and expectations. And remember that whichever option you choose, you can always change your mind later if your circumstances change.

Categories

Recent Posts