Balancing Your Wants and Needs as a Home Buyer

Though there are more homes for sale now than there were at this time last year, there’s still an undersupply with fewer houses available than in more normal, pre-pandemic years. The Monthly Housing Market Trends Report from realtor.com puts it this way: “While the number of homes for sale is increasing, it is still 43.2% lower than it was before the pandemic in 2017 to 2019. This means that there are still fewer homes available to buy on a typical day than there were a few years ago.” The current housing shortage has an impact on how you search for a home this spring. With limited options on the market, buyers who consider what’s a necessity versus what’s a nice-to-have will be more successful in their home search. The first step? Get pre-approved for a mortgage. Pre-approval helps you better understand what you can borrow for your home loan, and that plays an important role in how you’ll put your list together. After all, you don’t want to fall in love with a home that’s out of reach. Once you have a good grasp on your budget, the best way to prioritize all the features you want and need in a home is to put together a list. Here’s a great way to think about them before you begin: Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle. Nice-To-Haves – These are features you’d love to have but can live without. Nice-to-haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of the these, it’s a contender. Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner. Finally, once you’ve created your list and categorized it in a way that works for you, discuss it with your real estate agent. They’ll be able to help you refine the list further, coach you through the best ways to stick to it and find a home in your area that meets your needs. Bottom Line Prioritizing what you need in a home is a critical first step the buying process. If you’re ready to find the one that’s best for you, connect with a local real estate agent.

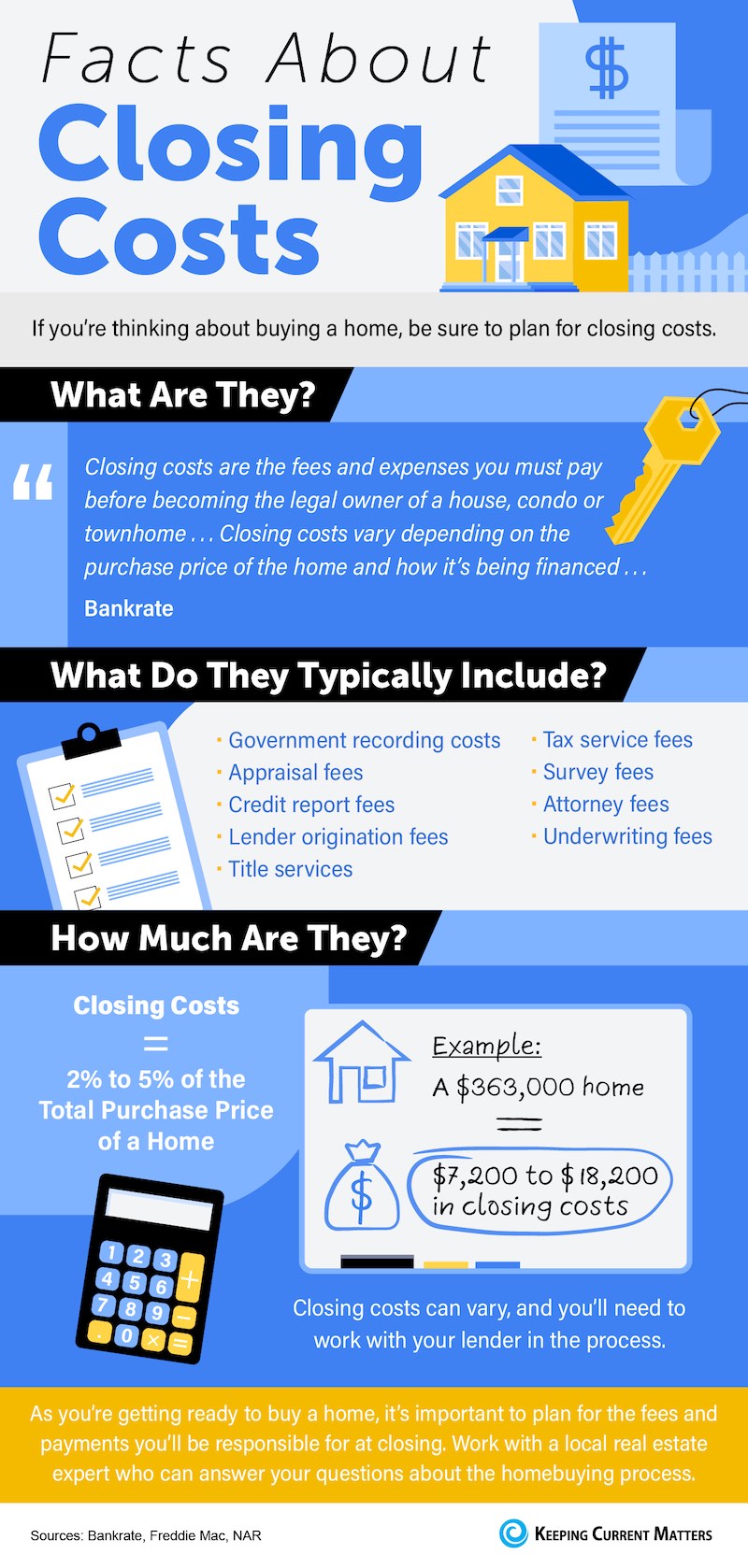

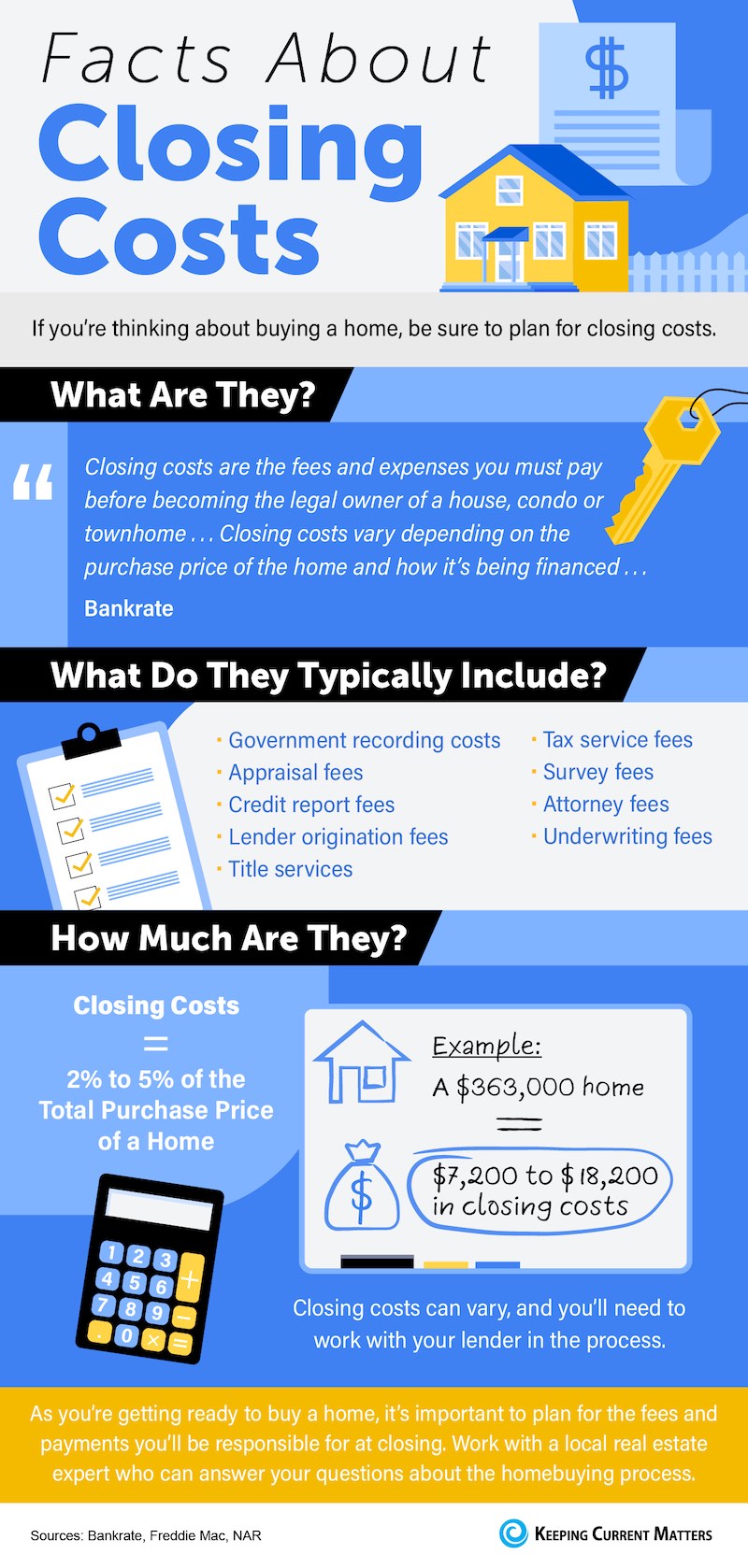

Facts About Closing Costs

Some Highlights If you’re thinking about buying a home, be sure to plan for closing costs. Closing costs are typically 2% to 5% of the total purchase price of a home, and they can include things like government recording costs, appraisal fees, and more. Work with a local real estate expert who can answer your questions about the homebuying process.

Homebuyer Activity Warming up for Spring

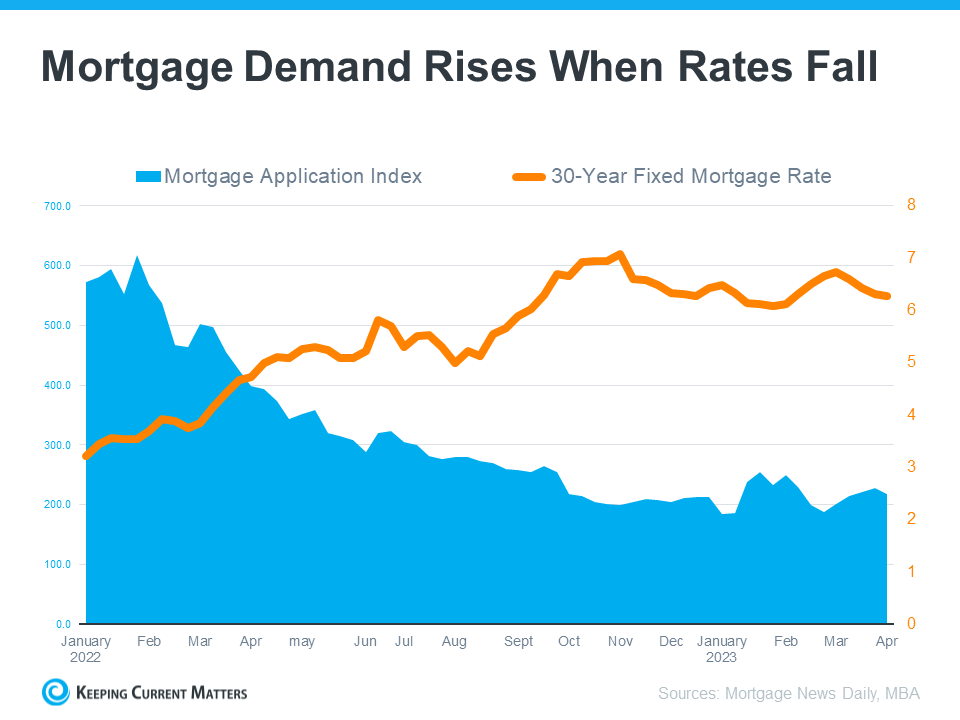

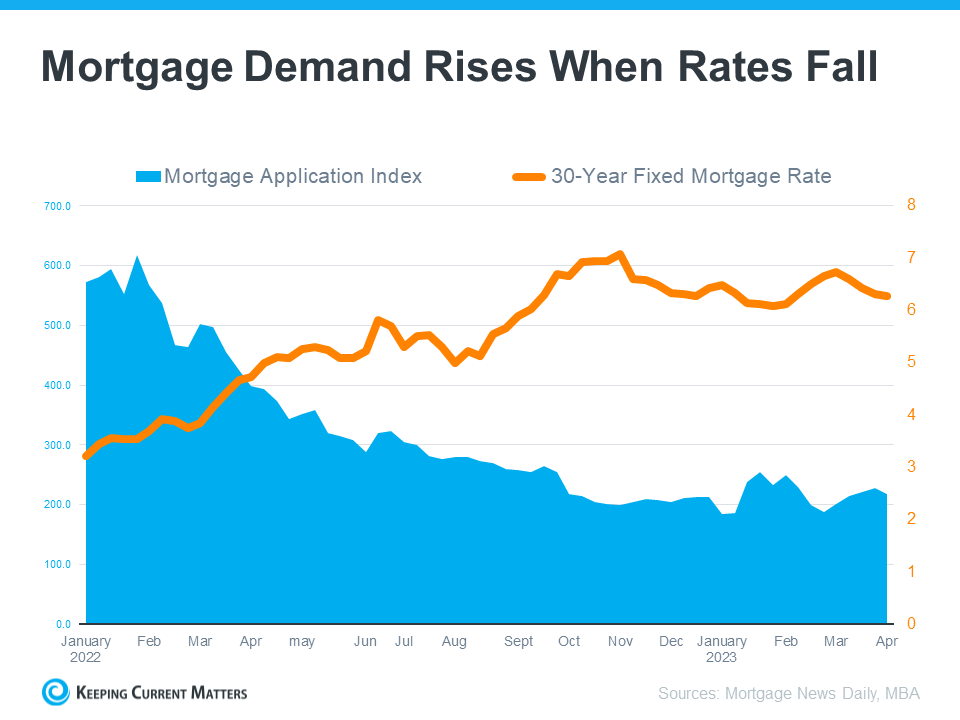

The spring season appears to be warming up in housing as more and more buyers enter the market. And after rising mortgage rates sidelined so many buyers last year, that’s a good sign for sellers. Realtor.com has the latest: “Spring is officially here, and like green shoots emerging from the bleak winter, new data suggests that more buyers are back in the market, although more subdued compared to a year ago.” We know buyer activity is trending up because of mortgage purchase application data. According to Investopedia: “A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate.” That means the number of mortgage applications shows how many buyers are applying for mortgages. Put another way, an increase in mortgage applications means an increase in buyer demand – and as Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains, application activity started ramping up as mortgage rates fell steadily in March: “Application activity increased as mortgage rates declined . . . recent increases, along with data from other sources showing an uptick in home sales, is a welcome development.” In fact, we can see how mortgage rates have a direct impact on applications over time. As rates rose dramatically last year, applications fell in response (see graph below): The recent uptick in mortgage applications, as well as the decline in mortgage rates, is good news for sellers because it means more buyers are actively looking for homes. What This Means for You Buyers are coming this spring, which is typically the busiest time of the year in real estate. And as Realtor.com tells us, if you’re a seller, you need to prepare: “If homeowners are planning to sell in 2023, now is the time to get ready.” The means working with a local real estate agent to maximize your home’s appeal and get it listed at the ideal price for your area. Bottom Line The housing market is warming up for spring. If you’re thinking about selling your house and taking advantage of this recent uptick in buyer activity, partner with a local real estate agent.

Categories

Recent Posts